Explore Guide Section

1.Self Fund

2.Build Early-Stage

3.Scale Impact

4.Fund Growth

Leadership

The ultimate introductory guide to funding your social enterprise

From Crowdfunding to Venture Capital - Discover the Advantages and Disadvantages of Types of Funding to Scale Your Social Venture

32 minutes

Social entrepreneurs are motivated by a desire to improve lives and systems.

In this four-part series, we’ll review the major types of capital along the impact capital spectrum. We’ll also share insights and perspectives from funders and entrepreneurs about their experience seeking and receiving different types of capital.

Self-fund and tap your inner circle to test and validate your idea

Self-funded (Bootstrapping)

Global Entrepreneurship Monitor 2016 found that the choice to bootstrap is often due to inaccessibility of other types of capital, especially for women entrepreneurs “who may face unequal treatment from traditional lenders, both in developed and developing countries (World Bank, 2015)”

Pros

- The founders keep full ownership of the company unlike accepting equity investment, and there are no additional costs like interest or fees when accepting debt financing.

Cons

- Since growth is limited by founders’ savings or revenue earned, the speed of scaling can be slower than if one were to accept outside investment.

- Without outside funders, founders may miss out on the advice, mentorship, and network that is often attached to capital.

“The four of us all clearly had alignment around the absolute necessity that something like this needed to exist in Tanzania so we self-funded to begin.”

Krupa Patel

Founder, Silverleaf Academy

Close

I wanted to run it all the way bootstrap only because that’s where the fun is: you make money and then you put more money into the business, and grow it, and then make more money. But later I realized that it would take a lot of time for me and there are a lot more opportunities for impact and that impact can be escalated if I raise funds.

Maneet Gohil

Lab10

Friends + family

Mixing family and money can be a delicate situation. It’s best to document the agreement from the very beginning to ensure there is a shared understanding of repayment terms and conditions.

Pros

- Friends and family are not necessarily deterred by market trends or lack of company track record because they believe in the founder(s).

- When there are repayment plans, friends and family may be more lenient to shifting agreed upon terms.

Cons

- Accepting funding from friends and family has the potential to strain relationships should there be miscommunication about expectations like terms and conditions of repayment, or if the money is never ultimately returned or recovered.

We didn't have anything to show to anyone. We had imported a number of products and tested them in the marketplace. We didn't have traction. We didn't have revenues. We had an idea. And at the idea stage, I think the easiest thing to do is to turn to friends and family, and that's what we did.

Khizr Tajammul

Jaan Pakistan

Close

Part 2 of this series goes into options to raise capital over short-term engagements to continue building momentum in the early days: crowdfunding and competitions. These specialized methods can secure quick injections of capital and provide the necessary boost you need to keep charging forward.

Build early-stage momentum with crowdfunding, competitions, and programs (Incubators and accelerators), and grants

Part one of this series explores early-stage capital to grow a social enterprise. Personal savings and a friends and family round can ignite the spark, but that flicker will quickly extinguish unless more fuel is added.

Short-term engagements like crowdfunding or impact-focused competitions and programs can supply much-needed capital, especially if you’re trying to become ‘investment-ready’ for more traditional types of capital.

Just as critical, but often overlooked, are the non-financial benefits that come with these experiences: mentorship, networks, and exposure.

Crowdfunding

What’s more, Bre DiGiammarino explains that crowdfunding is, “no longer just the first-time entrepreneur... We’re finding repeat entrepreneurs who use it again and again to bring new products to market, and even established companies that are using it to launch exciting new products and learn about what is working in their community.”

Pros

- Running a crowdfunding campaign can be an excellent way to validate your product and show future funders there is market demand and willingness to pay for your product.

- Campaigns build social capital (a community of supporters) in addition to financial capital

- Crowdfunding can supersede systemic barriers faced by women and people of color.

Cons

- It can be time consuming to run a successful crowdfunding campaign due to the level of planning and promotion efforts involved.

- Not all funds raised will be available for business needs because generally a large portion of funds raised go towards supplying backers with ‘perks’.

- The obligation to deliver rewards in a timely manner can be challenging, especially for goods in their first major manufacturing run.

Close

Competitions

Overall, competitions can be a way to fast track your learning as a new founder. The judging rules provide concrete criteria to focus your efforts and pitching your idea forces you to practice explaining what you do and why in a compelling manner. Even if you don’t end up taking home cash for top prize, the experience of putting yourself into the spotlight can lead to many unexpected and welcome benefits in terms of building your network and awareness for your social enterprise.

Pros

- Presenting at competitions provides a platform for greater exposure to your community (if local), as well as potential funders, supporters and partners.

- Competitions generally come with a set of judging criteria that force participants to clearly articulate the fundamentals of their business, including ideal customers, business model, and financials. Although every entrepreneur should be clear on these, participating in a competition and receiving critique and questions from judges can be a great learning experience.

Cons

- Preparation for Pitch Competitions can be very time-consuming. If participating in too many, the process of continuous pitch preparation and practice can distract from focusing on growing the business itself.

Close

Incubators and Accelerators

With a variety of program types, it’s important to understand the time commitment and responsibilities of participation and to make sure the goals of the program align with yours.

Pros

- There are many incubator and accelerator for social entrepreneurs that come with various levels and structures of funding.

- Being selected to participate in a competitive program can boost your enterprise’s credibility and exposure.

- The primary goal of many accelerator programs is to prepare entrepreneurs to secure further funding with angel investors or venture capital. This can provide an excellent opportunity to get connected with the right investor networks if you plan to pursue more equity investment.

Cons

- Participating in these programs can be very time consuming. They can also be distracting if program goals are not aligned with the priorities of your stage of business and your organizational values and goals.

Grants

Although you don’t need to give up equity with grants, there can be a considerable amount of time invested both in the application phase before receiving the money, and in the reporting phase after receiving the money.

Pros

- Grant funding does not need to be repaid, and there is no additional cost associated with it other than time and managing a relationship with a funder.

Cons

- Applying for grants can be time-consuming. Most require some level of progress reporting and/or auditing to monitor use of funds and to confirm the level of impact that is generated.

Close

Close

Scale impact and revenues with debt and equity

Part one of this series explores how early-stage founders can tap into personal resources and the support of friends and family to fund seeds of a social venture idea.

Part two explores the benefits and drawbacks of accessing capital through crowdfunding, competitions, programs designed for social entrepreneurs, and grants.

Grant funding, crowdfunding, and other types of early stage capital can help you prove the business fundamentals of your company like market demand and revenue model, but at a certain point you’ll need to seek funding to scale.

The good news is that impact investing is gaining traction.

In the Global Impact Investing Network’s Sizing the Impact Investing Market report, the global impact investing market is estimated to be USD $502 billion, managed by over 1,340 organizations. The market has grown by 10 times since 2009 when funds under impact investment were $50 billion (Investopedia).

Despite the growth, there is still much to learn on the part of both entrepreneurs and investors.

As Brian Trelstad, former Chief Investment Officer at Acumen, and now Partner with Bridges Fund Management Ltd. shared in interview: “More clarity and more communication would go a long way to helping ensure that the capital that is allocated for impact delivers as much good as possible and the financial returns that people are seeking.”

Impact investors may have varying focuses in terms of geography, stage of business, or impact area, but they share the common objective of funding companies that are making an impact. However, many define and measure impact differently. For example, Acumen developed Lean Data to better understand how investee companies are making a real, lasting difference in the lives of low-income people.

Aside from considerations for impact potential, these funding vehicles work much the same as they would for a traditional, non-impact startup or company.

Raising capital at this stage, whether philanthropic or equity, is a challenging task for any entrepreneur. It takes an investment of time, building relationships, perfecting your pitch and mastering your mindset.

Sasha Dichter, former Chief Innovation Officer at Acumen and now co-founder of 60 Decibels, urges founders to examine their underlying beliefs about fundraising. Instead of fearing rejection, every fundraising conversation is an opportunity to serve both sides in a true exchange of value. Reframe your fear of fundraising with Sasha’s advice:

Close

We talk ourselves out of successful fundraising long before we ever get in the room with somebody.

Sasha Dichter

60 Decibels

Debt

Term loans

Pros

- Term loans can be a good option for financing assets and equipment that will increase efficiency or production. The revenue gains produced as a result can service (pay) the debt payments.

Cons

- Term loans generally have set repayment terms including the monthly installments and term length. Loans require repayment regardless of financial performance so if the business is struggling taking on a term loan may contribute to overall financial strain instead of alleviating it.

Revolving lines of credit

Pros

- You only pay interest on the amount you use, for the length of time the funds are drawn. Likewise, when funds aren’t being used, there is no interest charged (although there may still be bank fees).

Cons

- Because lines of credit are designed to cover temporary shortfalls in operational cashflow, they are not designed to finance the purchase of capital expenditures like equipment or assets.

Equity

Angel investment

Since many angel investors are focused on certain sectors or industries, it can be helpful to understand how their goals align with those of your organization.

Pros

- The capital does not need to be repaid; however, investors may receive dividends proportional with the company’s financial performance.

Cons

- If the investor is not aligned with your company’s values and mission, there could be disagreement about strategic direction and financial decisions.

- Securing angel investing can be contingent on your network, making it much more challenging for those traditionally excluded from capital opportunities - females, people of color, and companies based outside of hub cities like San Francisco or London.

Close

Venture capital

Close

Pros

- Venture capital can provide large injections of capital needed to scale quickly

- VC funding is often called ‘smart money’ because investors provide additional services, insights, and connections to help the company grow - it’s in their best interest, after all, to leverage the resources they have at hand!

- Venture capitalists are invested in your success for the long-haul, typically until the company is sold or goes public. This can be a huge asset, but it’s also important to put in the effort to maintain a good relationship over time

Close

Cons

- By giving up shares in the company in exchange for funding, you cede some of the decision-making control

- Raising VC funding can be a lengthy and time consuming process that takes focus away from the running of the business

Close

Close

Fund growth with types of capital specialized for social enterprise

Similar to new legal structures emerging around the world to support the growing sector of social enterprises, there are also new capital funding options that aim to better meet the needs of hybrid organizations.

While many social enterprises will do well navigating the spectrum of funding available to traditional for-profit and nonprofit organizations (explored in the first three parts of this series), depending on the circumstances, sometimes a more specialized option is a better fit.

Let’s explore four types of capital specialized for social enterprise:

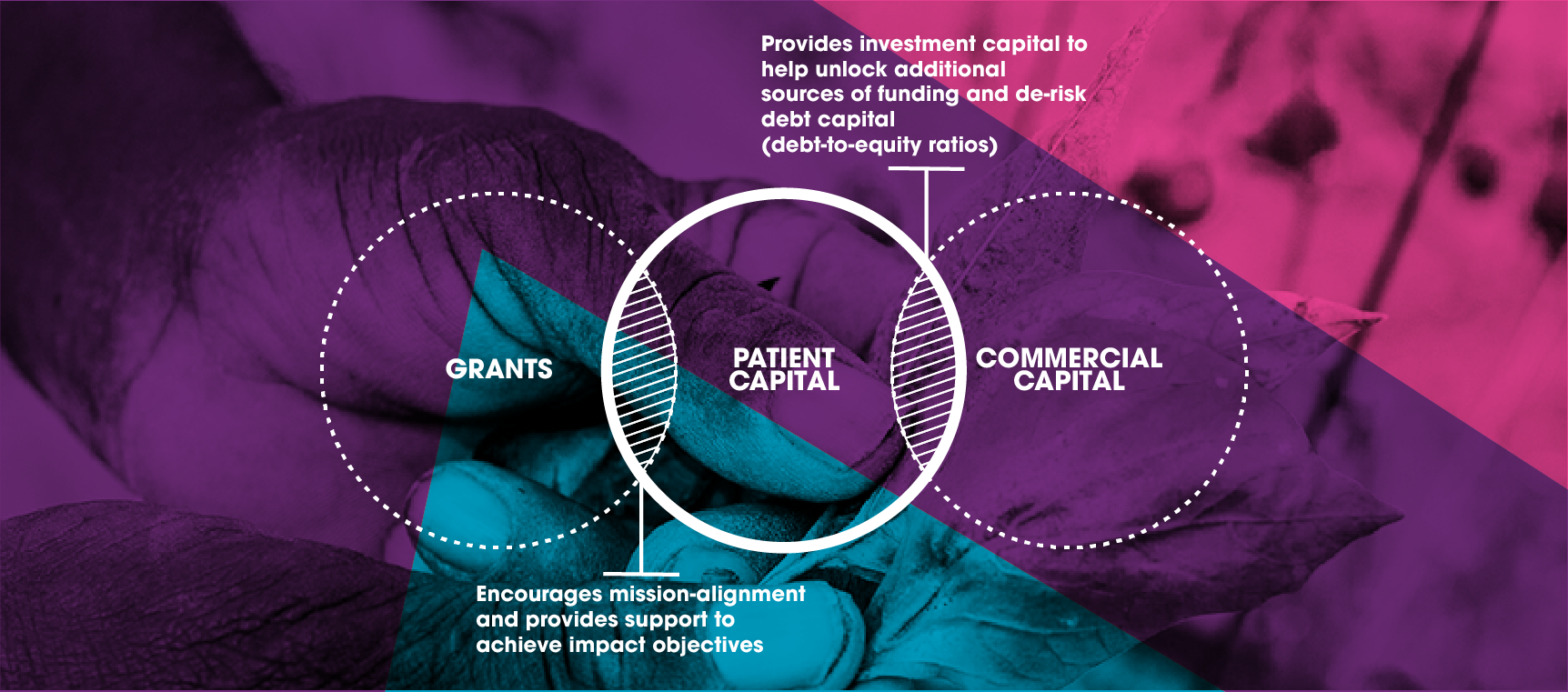

Patient capital

Distinguishing factors of patient capital

Learn more about patient capital:

- From Acumen: About Patient Capital

- Acumen’s report: Accelerating Energy Access: The Role of Patient Capital

- World Economic Forum: The Missing Ingredient in Innovation: Patience

Social impact bonds (SIBs)

- Service providers, who receive upfront funding needed to deliver a proven intervention to a community in need,

- Impact investors, who provide the capital to the service providers and later receive a return when agreed upon targets are met, and

- The government, who pays investors their initial capital plus a return after the intervention has been completed and measured. The repayment of initial capital invested and exact rate of return paid is determined by how closely achieved results match those expected and outlined at the beginning.

A social impact bond (SIB) is a contract with the public sector or governing authority, whereby it pays for better social outcomes in certain areas and passes on the part of the savings achieved to investors. A social impact bond is not a bond, per se, since repayment and return on investment are contingent upon the achievement of desired social outcomes; if the objectives are not achieved, investors receive neither a return nor repayment of principal.

Seven service providers helped ex-prisoners with substance abuse and mental health issues, helping to cut reoffending rates by 9%–above a target of 7.5%. The SIB therefore delivered a financial return of 3% on capital to foundations that funded the initiative.

There is still much to be explored to determine the efficacy and optimal use cases for implementing Social Impact Bonds to finance social impact.

Learn more about social impact bonds

- Articles from Social Finance

- Stanford Social Innovation Review - A Critical Reflection on Social Impact Bonds

- Stanford Social Innovation Review - Social Impact Bonds, More Than One Approach

- Fast Company - More Government Are Turning to Social Impact Bonds but Do They Deliver

- Canadian Centre for Policy Alternatives - Fast Facts About Social Impact Bonds

- Globe and Mail - The Dark Side of Social Impact Bonds

Quasi-equity: Revenue sharing agreements

Epstein also explains how quasi-equity provides benefits for both investors and entrepreneurs. From the investor’s side, it allows them to invest in impactful companies that aren’t necessarily able to show a clear path to exit through acquisition or IPO (initial public offering). For entrepreneurs, it provides the opportunity to align investors with the best interests of the company, since they will only receive a return when the company does well. For both sides, quasi-equity is a financing solution that offers more flexibility as an alternative to the long-term commitment of a straight-equity deal.

Learn more about quasi-equity

- Unreasonable Institute - Beyond Debt and Equity

- Business Development Bank of Canada - What is Quasi-Equity and How Can it Benefit Early Stage Companies

- Attract Capital - What is Quasi Equity and How Is It Different from Other Forms of Capital

Program-related investments (PRIs) And mission-related investments (MRIs)

Program-Related Investments (PRI): PRIs are investments made to charities as well as for-profit and non-profit enterprises to further the Foundation’s program objectives, but, unlike grants, they also aim to generate financial returns, with a tolerance for below-market returns.

Resources to learn more about program-related investments

Discover more

Sign up to our newsletter

I have read and accept the Terms & Privacy